What They Don’t Teach You in School About Money

From an early age, we’re told that going to school and getting a degree will set us up for financial success. However, as we grow and experience the real world, we often realize that schools don’t teach us everything we need to know about money.

Of course, basic math skills and concepts like saving money are covered, but there’s so much more to it than that. Below, we discuss financial concepts schools don’t teach you about and the importance of learning them.

How to Budget Effectively

One of the most essential skills schools don’t teach you about money is budgeting. Budgeting is a crucial part of managing your finances, and learning how to do it properly can help you avoid financial pitfalls such as overspending, debt, and even bankruptcy.

Breakingpic/ Pexels | Make sure you have a savings habit; everyone needs savings

Without effective budgeting skills, we often cannot save or spend our money wisely. Take some time to learn the basics of budgeting, such as tracking expenses, setting financial goals, and creating a realistic budget.

Understanding the Importance of Credit Scores

Another critical issue is the importance of credit scores. These scores can determine whether you can get a loan, a credit card, or even a rental home.

Having a good credit score is essential when it comes to making major financial decisions, and it’s something that you should start thinking about early on. Learn what factors affect credit scores, how to check and maintain your credit score, and the importance of paying bills on time.

Investing and Building Wealth

Schools often fail to teach about the importance of investing and building wealth. While we learn the basics of saving and budgeting, we don’t learn how to invest our money wisely.

Nataliya Vaitkevich/ Pexels | The hardest thing in the world to understand is the income tax

Investing is a way to build wealth over the long term, and there are various strategies you can use to do so. Learn about different types of investments, such as stocks, bonds, mutual funds, and real estate, and research the risks and rewards of each one.

Taxes and Accounting

Learning about taxes is important since we must pay them yearly and file them correctly. Knowing the basics of accounting can help you manage your finances more effectively, such as tracking expenses and income, identifying areas where you can save money, and preparing for financial emergencies.

The Importance of Financial Planning

Financial planning involves setting goals, creating a strategy, and taking action to achieve those goals. It’s a process that requires patience, persistence, and discipline, but it’s essential for achieving long-term financial stability.

Anna Nekrashevich/ Pexels | Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments.

Learn about the different aspects of financial planning, such as retirement, estate, insurance, and wealth management, and create a plan tailored to your goals and needs.

Entrepreneurship

Entrepreneurship is a key driver of economic growth, and students need to know the ropes. Students should be taught about the basics of entrepreneurship, the risks and rewards, and how to develop and execute a business plan. A basic understanding of entrepreneurship can lead to a more entrepreneurial mindset, which could benefit both the individual and the economy.

More in Wealth

-

`

What Must an Entrepreneur Do After Creating a Business Plan? Here’s a Step-By-Step Guide

Many successful entrepreneurs start with a solid business plan detailing the factors of their business, such as marketing, funding, legal considerations,...

June 2, 2024 -

`

Barbie Movies Are Outperforming Other U.S. Movies in China – Here’s Why

The Barbie movie is a huge hit in China! While lots of American movies usually do not do so well there,...

April 26, 2024 -

`

Hollywood Greatest Comebacks: Actors Who Staged Remarkable Returns

Hollywood may sparkle with glitz and glamor, but it’s a tough business. Stars who once basked in the spotlight can find...

April 26, 2024 -

`

Misinformation Is the New Normal: How You Can Spot Misinformation Online

In the ever-evolving world of the Internet, where information and misinformation intertwine like vines, it is essential to know how to...

April 25, 2024 -

`

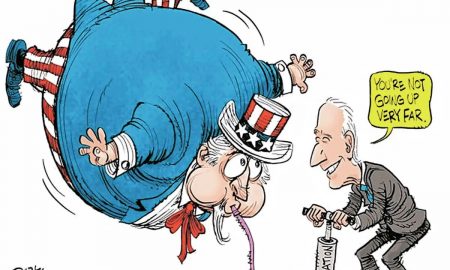

America is Rich But Americans Are Poor | This Best-Selling Book Explains Why

In the midst of America’s wealth and global dominance lies a startling and often overlooked reality: The persistent existence of poverty....

April 25, 2024 -

`

Work Presentations: How to Say Goodbye to Boring Office Meetings

Picture this: you’re in a conference room, surrounded by colleagues. The lights dim, a projector flickers to life, and there they...

April 24, 2024 -

`

Essential Documents for Opening a Business Bank Account: Your Checklist

Embarking on the entrepreneurial journey is exhilarating, but navigating the financial side of your venture requires thoughtful consideration. One pivotal step...

April 23, 2024 -

`

Gwyneth Paltrow Was Once Called out by NASA for This Bizarre Reason!

Once upon a time, Gwyneth Paltrow was considered to be one of the most promising actresses of her time. While she...

April 23, 2024 -

`

Discover the Royal Charm of Villa Maria Pia in Cascais, Portugal

Nestled on the sun-kissed north shore of Lisbon, the captivating town of Cascais, Portugal, harbors a secret steeped in royal history....

April 22, 2024

You must be logged in to post a comment Login